CROX SHOO

Since 2017, Lee Ainsle, Bill Miller, and Samantha McLemore have dabbled in CROX. They’re great investors with nice track records, but if you’re a value guy or gal, Miller & Mclemore’s jump into crypto probably turned you off a bit. Further, NVDA, AMZN, TSM, and MSFT are Ainsle’s top 4 holdings for a quarter of the portfolio. This group owning CROX doesn’t carry much weight — no real urge to peel the onion back.

Then the stock gaps down by almost a third earlier this month. 13Fs are subsequently released, and we see that Berkshire bought UNH, as did Burry, who also bought a good amount of LULU and VF after loading up on NVDA, BABA, and JD puts last quarter. Bearish to bullish, just like that. Tepper piled into UNH, too, making it his second-largest position, right behind BABA. Significant, unexpected moves, but none more so than Norbert Lou’s CROX purchase.

According to dataroma.com, Lou bought 531,108 shares of CROX at a reported price of $101.28 during Q2, a $53.8 million bet that's tucked right behind his $57 million SGOV position and $105.7 million BRK.A hoarding. CROX trades at around a 20% discount to Norbert’s cost basis, and given his need for a wide discount, we can deduce that the stock is well below intrinsic value. Not really though. We'd need to do work and put ourselves in his shoes first.

This article from the “Santangel’s Review” from November of 2011 is a good start: https://santangelsreview.com/wp-content/uploads/2024/11/Vol-5.-Santangels-Review-Punch-Card-Capital.pdf.

Here are some clippings from it with brief commentary:

Norbert grew up in the small town of Windsor, Connecticut, and attended Windsor High School, where a quarter of graduates didn’t attent college. His dad was a nuclear engineer at Combustion Engineering and also worked at H.F. Brown, a tobacco company. His mother was an accountant.

“It was not a privileged education, but whatever disadvantages Norbert faced there were more than offset by the academic expectations his parents carried with them as immigrants from Taiwan and China: My mom always used to say that I couldn’t even comprehend the level of academic rigor in Taiwan. She used to say that she was third in her class, and it was the equivalent of being number one out of all the number ones in the US. I believed it, and realized that I had to work hard and give my best effort, because I wasn’t that special once you expanded the competitive pool.”

Norbert’s humble. He is special, no matter the pool. Hartford University is where he studied mathematics in high school, and the valedictorian went on to study agricultural and biological engineering at Cornell.

“I used to read the biology textbooks page by page, really slowly, and when I read something I didn’t totally process, I’d get concerned and read it again”.

As well, Lou’s inquisitive mind shunned his father’s teaching of technical analysis. Yes, his dad left a nuclear engineering job to be a chart-touting stockbroker. A career switch that could be deemed the impetus of his son’s legendary value investing journey.

“He was really into technical analysis, and one of the first things he taught me was Elliott Wave Theory, Norbert remembered. An investment strategy based on identifying patterns in charts seemed like loopiness. If anything, that made me more skeptical of finance.”

Returning home from summer after his sophomore year at Cornell, Norbert picked up Peter Lynch’s One Up on Wall Street from his father’s bookshelf (guess it wasn’t all charts for dad).

“Analyzing stocks by analyzing the underlying companies felt logical,” Norbert said. “When Lynch talked about identifying investments by analyzing businesses, that seemed like an approach worth exploring.”

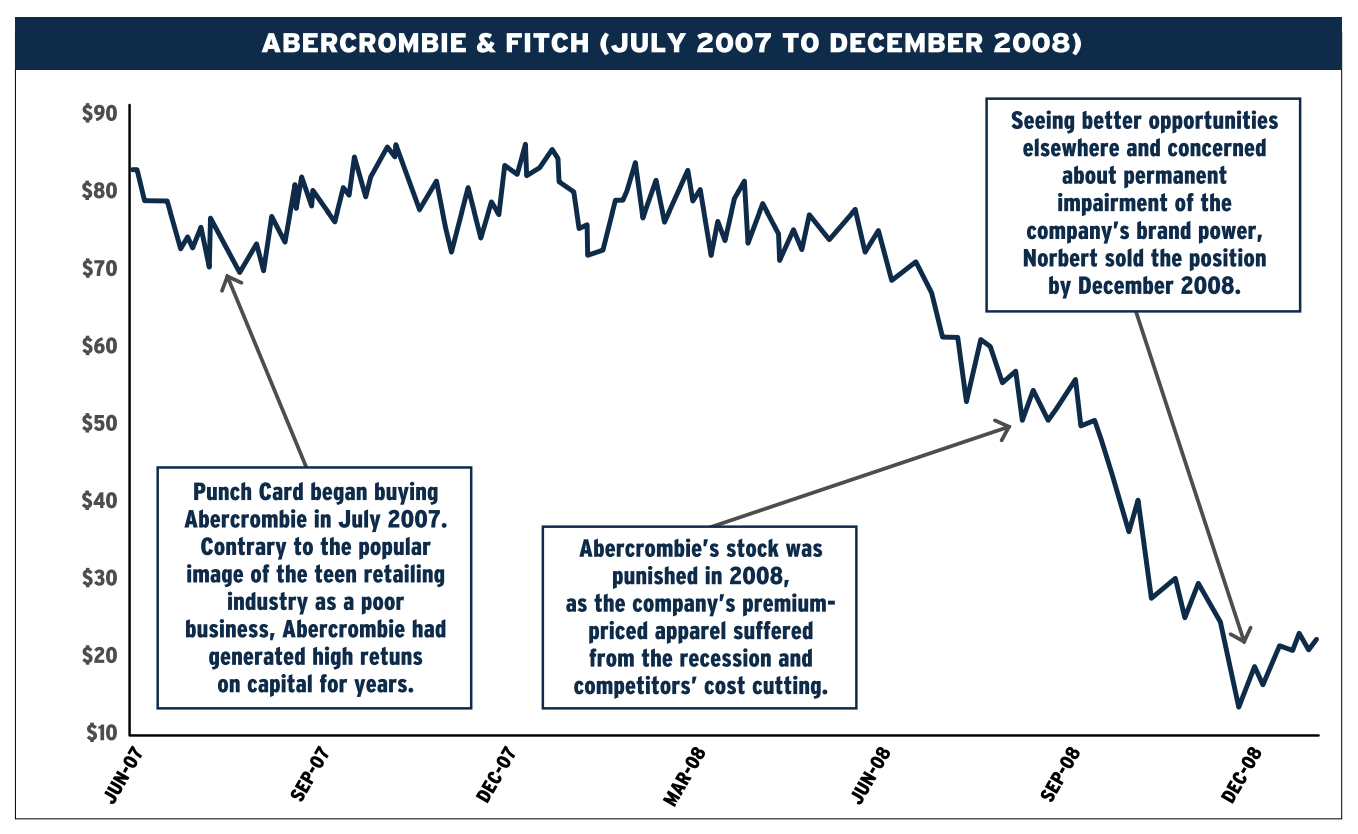

And explore he did. To keep a long story short, Norbert worked at BBH, Elliot, and was funded by Gotham (Greenglatt and Petry) to start Punch Card. Norbert crushed it and only made one mistake of commission. That was buying Abercrombie & Fitch (ANF) before the economy went off a cliff.

“Most people think of teen retailing as a fickle industry prone to fads,” Norbert said. “But several generations of teens had seen Abercrombie’s products and they all were willing to part with a large portion of their money to buy them.”

Norbert was right, but his timing was off. He paid 6x operating income for a consumer cyclical and got slammed. ANF quintupled off the bottom, and the retailer is still selling trendy women’s clothing today. And now Norbert is looking for retribution almost two decades later. He’s picked another consumer cyclical as consumers are stretched, but this time at 4.5x operating income. CROX has high returns on capital, insane growth, cult-like brand loyalty, and prodigious free cash flow.

Barring that $2 billion HeyDude acquisition, management has acted smartly. Since 2022, they’ve wiped out around $1 billion of long-term debt. From 2019 to 2024, the share count was reduced by 16.7% and FCF per share exploded for a twenty-threefold gain. That’s a bingo for Punch Card, but it feels like deja vu. Why not wait for a busted economy and swoop shares at ultra-depressed levels? 2007 to 2010: CROX’s market cap plunged from $3 billion to $100 million to $1.5 billion. So wait for the fat dip after this dip, or find out why it’s worthy of a punch in the card right now.

Another punished footwear stock is SHOO – Steve Madden Ltd., or more famously known as Steeeeeeeeveeee Maaaaadddeeennn. It’s popped 36.1% off this year’s low but still trades at an 8.9% free cash yield. Pretty good, considering how stable free cash flow generation has been. SHOO also chugged along just fine during the GFC. Revenues did take a 9% hit in 2007, but the next few years saw growth of 6.0%, 10.2%, and 26.2%. Free cash flow was solid too at $46.9 million, $33.5 million, and $60.9 million. A girl really does need her shoes. I wrote up the stock when it was at $22.94 in the spring, but I wouldn’t buy at the current price. Here’s a link to it: https://waterboystocks.substack.com/p/steven-madden-ltd

ANF is good comp, thanks for looking into that. I know a few of Norbert's investments, but not that one.